As digital payments have evolved, cryptocurrency has become a viable alternative to traditional payment methods. Because of its decentralized nature, cryptographic safety and global accessibility, cryptocurrency has captured the attention of consumers and businesses alike. A potential area where cryptocurrency could play a large role is the future of Apple Pay.

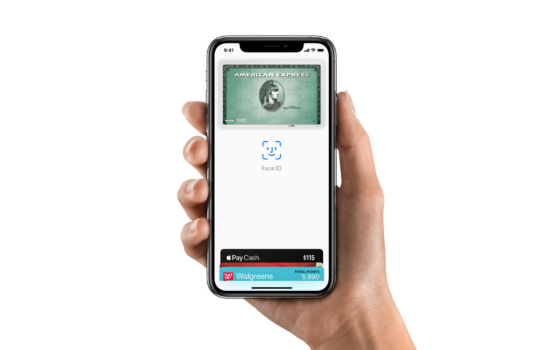

Apple Pay currently enables users to make payments using their iPhone, Apple Watch or other Apple devices at participating retailers. It is a comfortable and secure way to make transactions without the use of physical cash or cards. However, the current system has limits, such as the requirement to link a debit or credit card to the account.

Cryptocurrency, on the other hand, may offer a more flexible and safer way for Apple Pay users to pay. The benefits of using cryptocurrency as a payment method includes better privacy and security, faster transaction time, and ability to earn rewards using cryptocurrency. Apple execs have also indicated their interest in the possibility of using cryptocurrency in Apple Pay, suggesting that we could see some integration in the future.

The Current State of Apple Pay

Apple Pay was presented in 2014 as a way for users to make payments using their Apple devices. It has become increasingly popular since then, with more and more retailers accepting this method of payment. In 2020, Apple Pay was used by approximately 507 million users around the world, which makes it one of the most popular digital payment methods.

One of the key characteristics of Apple Pay is its security. Payments are processed using a tokenization system that replaces the user’s credit or debit card information with a unique ID, which makes it harder for fraudsters to get confidential information. In addition, Apple Pay transactions are also authenticated using Touch ID or Face ID, which adds an extra level of security.

Despite its popularity and security features, there are limitations to the current Apple Pay system. For example, users need to link a debit or credit card to their account, which could potentially expose sensitive information. Additionally, there are limitations to the number of countries where Apple Pay is accepted, which limits its global accessibility.

The pros and cons of cryptocurrency

One of the main benefits of cryptocurrency is its decentralized nature, which means that it is not under the control of any government or financial institute. That makes it a more secure method of payment because it is not exposed to the same kind of regulatory oversight as traditional payment methods.

Another benefit of cryptocurrency is its cryptographic security. Complex algorithms and protocols are used to secure transactions, making it almost impossible for hackers to manipulate the system.

However, there are also disadvantages in using cryptocurrency as a payment method. One of the most significant drawbacks is its volatility. Cryptocurrencies like Bitcoin and Ethereum are known for their wild price fluctuations, which could potentially make it difficult for consumers and retailers to rely on them as a stable payment method.

Additionally, there are concerns about the accessibility of cryptocurrency. While it is true that anyone can purchase cryptocurrency, not everyone has the technological knowledge for using it. This could limit its adoption among the general population.

Apple’s Potential Interest in Cryptocurrency

Despite the potential drawbacks, Apple executives have expressed interest in the potential of cryptocurrency for Apple Pay.

Other Apple executives have also hinted at the potential of cryptocurrency for Apple Pay.

Jennifer Bailey, Vice President of Apple Pay, said in a 2019 interview that the company is “looking at” cryptocurrency and that it has “great long-term potential.” Additionally, in 2021, Apple posted a job listing seeking a business development manager with experience in cryptocurrency.

This suggests that Apple is actively exploring ways to incorporate cryptocurrency into Apple Pay. If successful, this could have significant implications for the future of digital payments.

Potential Benefits of Combining Cryptocurrency and Apple Pay

So, what are the potential benefits of combining cryptocurrency and Apple Pay? There are several potential advantages, including:

Greater Privacy and Security: Cryptocurrency transactions are more secure than traditional payment methods because they’re processed using complex cryptographic algorithms. Additionally, since cryptocurrency transactions don’t involve intermediaries like banks or credit card companies, there’s less potential for fraud or data breaches.

Faster Transactions: Cryptocurrency transactions are processed much faster than traditional payment methods because they don’t require intermediaries. This could make transactions more efficient and convenient for both consumers and retailers.

Global Accessibility: Cryptocurrency is a global payment method, which means that it can be used anywhere in the world. This could make it a more attractive payment option for international transactions.

Rewards: Many cryptocurrency platforms offer rewards to users for participating in the network. This could incentivize users to adopt cryptocurrency as a payment method and could potentially drive adoption of Apple Pay.

Potential Challenges and Obstacles

While the potential benefits of combining cryptocurrency and Apple Pay are significant, there are also potential challenges and obstacles to consider. These include:

Regulatory Issues: Cryptocurrency is a relatively new technology, and there are still many regulatory issues to work out. Apple would need to navigate these regulatory hurdles in order to incorporate cryptocurrency into Apple Pay.

User Adoption: While cryptocurrency has gained popularity in recent years, it’s still not widely used among the general population. Apple would need to work on educating users about the benefits of cryptocurrency and how to use it in order to drive adoption.

Technical Complexity: Cryptocurrency is a complex technology, and integrating it into Apple Pay would require significant technical expertise. Apple would need to work with experienced cryptocurrency developers to ensure a smooth integration.

Future Outlook

Despite the potential challenges, the future looks bright for the potential of cryptocurrency in the future of Apple Pay. As the world becomes more digital and consumers demand more secure and convenient payment options, cryptocurrency is poised to become an increasingly popular payment method.

One area where we could see some potential developments is in the ad format for crypto banners. Companies like Bitmedia.io offer innovative ad formats for cryptocurrency advertising, including display ads, native ads, and video ads. These ads could potentially be integrated into Apple Pay, allowing users to earn rewards for engaging with cryptocurrency advertisements.

Conclusion

In conclusion, the potential of cryptocurrency in the future of Apple Pay is significant. While there are challenges to overcome, the benefits of combining cryptocurrency and Apple Pay could be significant, including greater privacy and security, faster transactions, and global accessibility. With Apple’s interest in the technology, we could see some exciting developments in the coming years, including potential partnerships with companies like Bitmedia.io for innovative ad formats.