Apple Card has been around for nearly five full years as of 2024. I have personally had it since November 2019 and it was my first ever credit card after I graduated from college back in May 2019.

Over the last few years, I have been able to fully use and take advantage of Apple Card and its features.

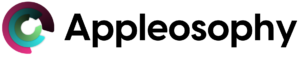

For starters, the first thing that I still love about using Apple Card is how convenient it is to use, as well as its transparency. Simply opening the Wallet app on my iPhone 15 Plus or by tapping the side-button twice on the Apple Watch and having easy access to my Apple Card to make purchases is so simplistic but feels natural as an Apple product and service user.

I do also like the fact that paying the bill each month through the Wallet app and how it tells you everything you need to know, how much of a payment you need to make, and what interest fees (if any) will be added to your bill.

What I use my Apple Card the most is probably subscriptions like my Apple Music, Paramount+, iCloud+, and others. They all go through Apple’s in-app purchases, meaning I get 3% in Daily Cash each time a purchase comes through.

Other uses include online shopping purchases and making big in-store purchases. A classic example of that this year has been the two HomePod Minis I purchased in April and May, and the PlayStation 5 I purchased last week.

When it comes to Daily Cash, while I do obviously wish that the percentages were a little higher (something like 1% in Daily Cash for using the physical card but 4% for purchases made at stores that accept Apple Pay, and then 5% Daily Cash merchants instead of 3%), it does come in handy.

As I write this, I currently have over $20 in Daily Cash on my Apple Cash card. Most of that money is going to end up being used at the Hallmark store next week for an item that will be released next week.

In the past, I have used Daily Cash to pay for subscriptions, food from fast food places, and books through ThriftBooks and eBay. For me, it’s all about getting the most out of it since it is free money in a way. The key though is to use it wisely.

Additionally, I use it around the holidays for expensive gifts because I am always fearful of someone “hacking” my card or card number. It would be pretty hard to do with Apple Card, but I’d rather be safe than sorry. Plus, by putting it on my Apple Card, it gives me more time to adequately pay it off.

I do not do anything with the Apple Card Savings Account because”¦.well, I just don’t. Perhaps I will one day but it is not something I do right now, so I cannot comment too much on that feature.

If there was anything I wish Apple would do with Apple Card, it would be to get a 3% Apple Card that is bookstore-related. Get Barnes & Noble or Books-A-Million (BAM) to be one. Granted, B&N does have it owns credit card so that could be considered a conflict of interest there, but BAM stores are excellent.

Additionally, Apple needs to work out its issues with Goldman Sachs (financial institution on Apple Card). In the meantime, in case the truly unfortunate happens and Apple Card were to get shut down because of that, I do have a backup credit card, which is ironically a Barnes & Noble credit card. It also just makes for a good backup credit card in general.

All in all, while my credit card uses are probably small and minimal compared to how other people use them, I do heavily enjoy Apple Card and do believe it to be the best credit card on the market when it comes to user-friendliness and transparency. That is why it still gets a 4/4-star ratings from me in 2024.

Rating: 4/4 stars