Apple Card Savings account users found out Wednesday night that the interest rates on their accounts have fallen once again.

A notification sent to users in the Wallet app reads that the new annual percentage yield (APY) is 3.9%, marking the first time the interest rate has dr0pped to less than four percent. APY represents the percentage of your balance you will make back in interest in one year.

The new low is less than the service’s APY at launch of 4.15% and a far cry from its all-time high of 4.5%. The rate last changed in October when it fell to 4.10%.

The rate cut brings the Apple Card Savings account in line with many other similar services — namely Marcus by Goldman Sachs, Apple’s partner in the Savings feature and the Apple Card as a whole. Other similar services offer an APY of up to five percent.

High-yield savings accounts like Apple Card Savings allow users to earn more interest on their unspent cash than they would at a traditional bank. Provider banks do, however, change high-yield savings account interest rates more frequently in line with U.S. Federal Reserve benchmark rate adjustments and other economic indicators.

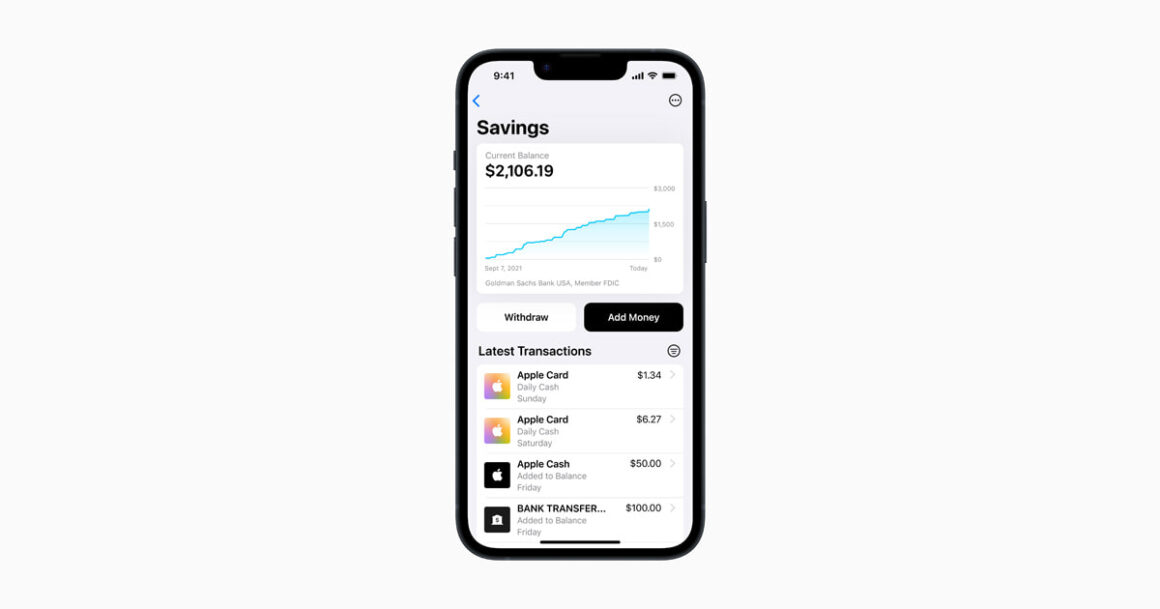

Apple launched the Savings account feature in partnership with Goldman Sachs in April 2023 after announcing it in 2022 as an exclusive feature for Apple Card holders. It allows users to automatically save their Daily Cash earnings from Apple Card purchases as well as other funds they deposit through a linked bank account or Apple Cash account.

Users can create and manage their accounts from inside the Wallet app under their Apple Card. Interest compounds daily and is paid out at the end of every month.

Reports indicate Goldman Sachs executives want out of their partnership with Apple on the Apple Card and Savings account features. American Express and Synchrony previously expressed interest, but the latest reports indicate JPMorgan Chase executives have been in talks with Apple about taking over the services.