In today’s environment, people even prefer the use of digital payment tools more than they used to do before. Using Apple Pay, like many other payment methods, is helping Americans manage their money. These tools are fast, safe, never out of reach, and very convenient. You’ll learn how to use Apple Pay during loan payment processing and how it can help you manage your money.

What Are Digital Tools for Loan Repayments?

Digital payments are generally applications that enable customers to make transactions or use virtual services. They allow you to transfer such money, pay various bills, and oversee your finances using your phone or computer. These tools are useful for loan repayments because they swiftly and conveniently perform payments.

You can pay your bills automatically to avoid forgetting a certain month when the payment is due. Most platforms are quite safe and secure, employing data encryption. Additionally, they can provide details about all your payments, making managing finances easier.

Examples include Apple Pay, Google Pay, and other electronic wallet service providers. Apple Pay allows you to pay using your iPhone or Apple Watch. Google Pay is similar but is usable only on Android devices. PayPal is popular for buying and making payments online and for transferring funds.

How Do Financial Companies Create Modern Loan Repayment Solutions?

Lenders in the financial industry are using technology to make loan repayment easier and more lenient. Companies such as 15M Finance employ high-tech features like applications and internet interfaces to assist the digital lending process. These tools enable loan tracking, reminder setting, and even a biopsy of repayment schedules that match the borrower’s financial capability.

Convenience is one of the biggest advantages of collaborating with a knowledgeable technical financial counterpart. All the processing can be done online, and one does not have to attend the usual branch to have an account. They also have options and services such as automatic payment to minimize the tariffs for late payments. Second, there is an understanding that the financial situation becomes more transparent, which makes it easier to make relevant decisions.

How Do I Use Apple Pay for Loan Repayments?

Apple Pay loan repayment is as easy as a pie. Here’s how to repay a loan by Apple Pay:

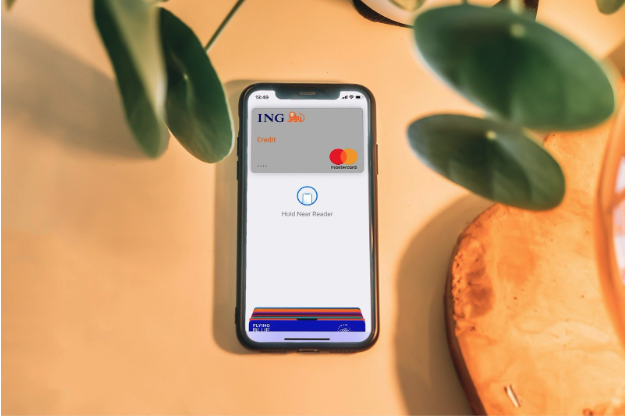

- Set up Apple Pay. To get started, check that Apple Pay is enabled on your iPhone or any other device you plan to use. If you don’t already have it, download and install the Wallet app on your iPhone. Then, tap the plus sign and the icon that looks like a square made of credit cards to add your credit or debit card.

- Link your loan repayment account. After that, connect your loan account to Apple Pay service. Many lenders give you the option of paying via Apple Pay. It’s best to consult your loan provider and see if their system allows it.

- Make secure and instant payments. If the loan provider requires payment, there is a smooth process of going through the whole extent of Apple Pay. All you need to do is go to the app or website used by the loan provider and then use Apple Pay as the payment method. After completing it, you should verify your payment through Face ID or Touch ID. It’s fast and secure.

Other Digital Tools for Faster Loan Payments

Digital tools, such as Google Pay, PayPal, and direct bank transfers, offer many options for making faster loan payments.

- Google Pay. This platform allows you to repay loans from banks or your credit card. The process is fast, easy, and secure. The downside? It can be limited depending on where the buyer or the lender is.

- PayPal. Yet another option for immediate payments. Easy to sign in and instantly pay with your account connected. And, it provides buyers protection. The demerit is that PayPal may deduct fees from some type of payment, particularly those using credit cards.

- Direct Bank Transfers. They are fairly basic and can also be commission-shy. You install them once, and they will effectively process your payments. However, they can be slower than the other methods and take a few days to process.

Advantages of Using Digital Tools for Loan Repayments

Several digital tools facilitate loan repayment processes so that different courses of credit repayment can be accomplished in short periods. Borrowers are not required to go to a bank or wait hours to pay their loans. These tools save time and make the process much easier than browsing for them alone.

“Digital tools are also safer than conventional methods of payment. When using digital tools, your payment information is encrypted, and other measures are taken. This makes them safer to handle, eliminating the risks associated with being a victim of fraud, having your identity stolen, or forging cheques,” says Shania Brenson, the CEO of 15M Finance.

Another significant advantage is the automation of payment schedules. You can schedule payments to be made at an interval of one month. In this way, you are protected from forgetting about a payment with subsequent fines for delay. It saves time when you would otherwise think about when the payment must be made.

Potential Challenges and How to Overcome Them

It is common to see people using Apple Pay and the convenience of other processing methods to make loan repayments quicker as long as there are these difficulties. Here are a few common issues and how to resolve them:

- Technical glitches. Some transactions can go wrong or will take longer than anticipated. Try setting your device to startup, ensure your internet is working well, or seek assistance from the service provider.

- Limited acceptance. Some lenders or platforms, such as Apple Pay, are incompatible with digital payments. Ensure that the lender you work with allows the use of Apple Pay or that you use another means of payment, such as a bank transfer or credit card.

Future of Loan Repayments with Digital Tools

Thanks to digital platforms, repaying loans will be much easier in the future. Today, AI and other technologies have rapidly grown, especially in the financial industry. AI is already used to evaluate spending patterns and identify times when payments can be made. This makes loan management unique and easy.

“Another big trend is voice-activated payments. Consider not having to type out “pay my loan” into your phone or to a smart speaker, and it will be paid on the spot. Say goodbye to grappling with websites or applications,” affirms Terryl Payne, Financial Expert and Advisor of 15M Finance.

With these tools, the management of loans will be an easy task. It can also guide you to the next payment or offer you timely tips to make a payment based on your budget. Voice assistants will help with repayment processes, taking less time than remembering passwords or shuffling through apps.

Bottom Line

Employing services such as Apple Pay and others to make loan repayments is convenient and efficient. You can withdraw funds for loan repayments and repay your loans without having to pay extra charges when you are overdue by using your phone. These tools are safe and straightforward, and the process allows you to manage your payments without stress.