Apple Card has been out for about two and a half years now and given my experience with it, I can say that it is certainly a credit card young people today should consider.

I started using Apple Card in 2019 several months after I got my first job out of college. I attempted to get approved for it when it was initially released, but due to me not having a full-time job and a car loan at the time, I was not approved.

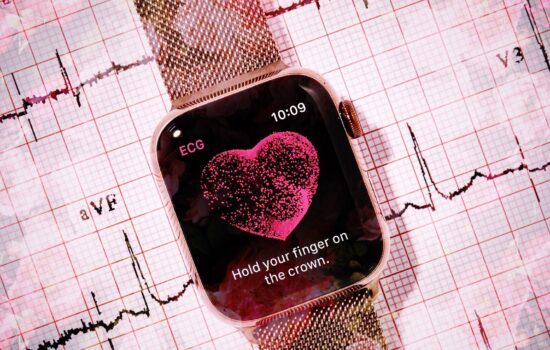

Since I was approved in November 2019, I can say accepting the card has been a decision I have not regretted. Not only does it make non-debit card purchases simple, but when the time comes each month for me to pay it, I just have to open the Wallet app on my iPhone 12 Mini and pay my bill there.

No need to open any other credit card app and pay it that way, or worst of all, get a physical paper bill in the mail and send a check to the card company. That last point in itself would be a step back if you asked me.

When it comes to making purchasing with the card and then getting Daily Cash for those purchases, it actually does not take too long to receive Daily Cash. I’d say it takes, at most, 48 hours to get it on the Apple Cash card in the Wallet app.

In my experience with using Daily Cash, I have been known to save it and borderline horde it. Still, I have used it to buy meals for myself, books from Barnes & Noble and ThriftBooks, and other small purchases for myself.

I know it may not sound like much, but it can come in handy when you have a day where you paid your rent or another bill, and you happen to be at a store and just want to buy a candy bar or soda, that is where this type of cash can come in handy.

The only part of Daily Cash that I hope Apple improves upon is adding more 3% merchants. It would be great to see a place like a well-known nationwide restaurant such as Applebees, Buffalo Wild Wings, or even a fast food place like Burger King or Wendy’s become a 3% Daily Cash merchant.

Oh, and to add more colors to the physical titanium Apple Card like a black/Space Gray color. The white Apple Card is nice and sleek, but at the same time, if you’re like me and use a black wallet, the color of the wallet tends to rub off on the card after it sits in there for weeks and months on end.

Now, why is the Apple Card this good for young people?

Most people in the Millennial and Gen Z demographics prefer to use an iPhone over any smartphone on the market right now. If that’s the case, then applying for, getting approved, accepting, and using the Apple Card is a seamless transition, especially if they were already using Apple Pay on their iPhone and/or Apple Watch.

To make it even better, you get that nice titanium physical Apple Card too. You may not use it often, but it does look luxurious and premium, and can be good for purchases at popular, yet non-Apple-Pay-accepting businesses like Walmart, Sam’s Club, and Amazon.

The only bad aspect about the Apple Card is they tend to have high-interest rates that are anywhere between 11.24-22.24%. However, as long as you make the necessary payments and do so on time, you can avoid interest on the cards altogether.

I do think it is one of the best if not the best credit card on the market for young people today. It has certainly been a good decision for me to use and I continue to get great use of it.